Frozen Snacks Market

Global Frozen Snacks Market Size, Share & Trends Analysis Report, by Product (Pizza, Potato Fries, Puffs, Meat Snacks, and Others), by Distribution Channel (Retail and Food Service Chain) and Forecast, 2020-2026

The global frozen snacks market is estimated to grow at a CAGR of 7.1% during the forecast period. Increasing demand for convenience foods and the rising availability of gluten-free frozen snacks are some pivotal factors contributing to market growth. Increasing demand for gluten-free frozen snacks has been witnessed owing to the rising inclination towards gluten-free alternatives among adults and a significant rise in the gluten-sensitive population. Therefore, the manufacturers of frozen foods are launching a new range of gluten-free frozen snacks with innovative taste and texture. For instance, in November 2019, Athens Foods declared the launch of all-new gluten-free frozen phyllo bites that are available in selected grocery stores across the US.

This new range of snacks brings classic Greek dough to an entirely new line of snacks for people having a gluten allergy, sensitivity, or preference. Phyllo bites are produced from delicate, crispy layers of phyllo wrapped with three savory fillings, including steak fiesta, spinach and cheese, and buffalo-style chicken. These bits are easy to indulge and quick to prepare and increase any occasion with a mouth-watering and tantalizing crisp flavor. Further, in October 2020, Central Foods, one of the frozen food distributors in the UK, is launching a new line of vegan and gluten-free pizza bases for the foodservice sector after partnering with White Rabbit Pizza Company.

The partnership between Central Foods and White Rabbit Pizza Co. marks the debut in the frozen foodservice sector. With this collaboration, foodservice sector professionals can buy the pizza bases and facilitates them to add their toppings to develop authentic free-from pizzas for serving in their venues. Central Foods will deliver 10-inch and 12-inch versions of vegan and gluten-free raised crust, stone-baked pizza bases of White Rabbit, referred to as nudies. The increasing focus on expanding the reach of new innovative gluten-free frozen snacks enabling to attract a large customer base, which in turn, is driving the market growth.

Market Segmentation

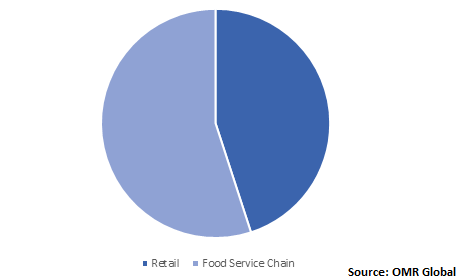

The global frozen snacks market is segmented based on product and distribution channels. Based on the product, the market is classified into pizza, potato fries, puffs, meat snacks, and others. Based on the distribution channel, the market is classified into retail and foodservice chain.

Expansion of Food Service Chains Accelerates the Market Growth

Expansion of foodservice chains such as McDonald’s, Pizza Hut, and Domino's Pizza, has resulted in increasing consumption of frozen pizzas. In April 2020, McDonald's Corp. declared its plans to expand in Russia's far east in December 2020. This aims to open restaurants in cities including Vladivostok and Khabarovsk for the first time. In 2020, McDonald's Corp. is continuing to actively invest in Russia’s economy and increase its presence on the market. In India, McDonald’s, Dominos Pizza, and Pizza Hut are continuously widening their footprint in the country. Domino's Pizza has more than 1,250 stores present all over India, which might further increase owing to the emerging demand for innovative pizzas in the country.

Global Frozen Snacks Market Share by Distribution Channel, 2019 (%)

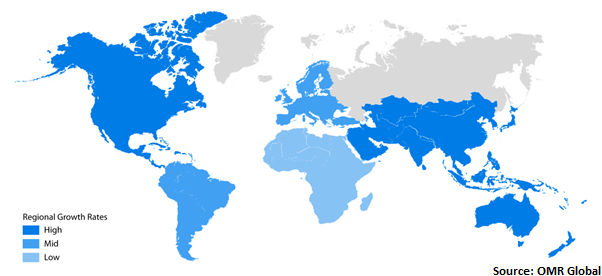

Regional Analysis

Geographically, the North American frozen snacks market is significant driven by the increasing demand for frozen foods in the region. As per the American Frozen Food Institute (AFFI), during the period, March to mid-April 2020, 86% of consumers had bought frozen food, of these 7% were new buyers of frozen food, who rarely or never purchased frozen food items before. The most frequently purchased frozen food categories were frozen meat/poultry, vegetables, and pizza. Nearly 1/3rd of consumers stocked up more than normal on frozen pizza, vegetables, meat/poultry than pre-pandemic. This rising consumption of frozen foods is supporting to fuel the market growth in the region.

Global Frozen Snacks Market Growth, by Region 2020-2026

Market Players Outlook

Some key players in the market include Nestlé S.A., General Mills, Inc., CJ CheilJedang Corp., Conagra Brands, Inc., McCain Foods Ltd., and Tyson Foods, Inc. Product launches and mergers and acquisitions are some key strategic initiatives adopted by the market players to leverage their market share. For instance, in February 2019, CJ CheilJedang acquired major Schwan's Company, a US food firm to become one of the major global food companies. Schwan's Company is renowned for its retail pizza brands like Freschetta, Tony's, and Red Baron. This will enable CJ CheilJedang to set up the base for the globalization of Korean food culture by securing the ‘K-Food expansion platform’ with an infrastructure of food manufacturing and distribution as well as R&D infrastructure all over the US. Additionally, CJ CheilJedang will increase its food business portfolio with a comprehensive line of Asian foods distinguished from Korean food taste. The company may expand its markets across countries such as Canada and Mexico.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global frozen snacks market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Nestlé S.A.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. General Mills, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Conagra Brands, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. McCain Foods Ltd.

1.1.1.1. Overview

1.1.1.2. Financial Analysis

1.1.1.3. SWOT Analysis

1.1.1.4. Recent Developments

1.1.2. Tyson Foods, Inc.

1.1.2.1. Overview

1.1.2.2. Financial Analysis

1.1.2.3. SWOT Analysis

1.1.2.4. Recent Developments

2. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

3. Market Segmentation

3.1. Global Frozen Snacks Market by Product

3.1.1. Pizza

3.1.2. Potato Fries

3.1.3. Puffs

3.1.4. Meat Snacks

3.1.5. Others

3.2. Global Frozen Snacks Market by Distribution Channel

3.2.1. Retail

3.2.2. Food Service Chain

4. Regional Analysis

4.1. North America

4.1.1. United States

4.1.2. Canada

4.2. Europe

4.2.1. UK

4.2.2. Germany

4.2.3. Italy

4.2.4. Spain

4.2.5. France

4.2.6. Rest of Europe

4.3. Asia-Pacific

4.3.1. China

4.3.2. India

4.3.3. Japan

4.3.4. Rest of Asia-Pacific

4.4. Rest of the World

5. Company Profiles

5.1. Amy's Kitchen, Inc.

5.2. Atkins Nutritionals, Inc. (Simply Good Foods USA, Inc.)

5.3. Bellisio Foods, Inc.

5.4. Bernatello's Foods

5.5. California Pizza Kitchen, Inc.

5.6. Caulipower LLC

5.7. CJ CheilJedang Corp.

5.8. Conagra Brands Inc.

5.9. Convenio Foods International Pvt. Ltd.

5.10. Daiya Foods Inc.

5.11. Dr. August Oetker Nahrungsmittel KG

5.12. General Mills, Inc.

5.13. Hansen Foods, LLC

5.14. McCain Foods, Ltd.

5.15. Nestlé S.A.

5.16. Newman’s Own, Inc.

5.17. One Planet Pizza

5.18. Orkla ASA

5.19. Palermo Villa, Inc.

5.20. Südzucker AG

5.21. Tyson Foods, Inc.

1. GLOBAL FROZEN SNACKS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

2. GLOBAL FROZEN PIZZA MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL FROZEN POTATO FRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL FROZEN PUFFS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL FROZEN MEAT SNACKS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER FROZEN SNACKS PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL FROZEN SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

8. GLOBAL FROZEN SNACKS IN RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL FROZEN SNACKS IN FOOD SERVICE CHAIN MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL FROZEN SNACKS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN FROZEN SNACKS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN FROZEN SNACKS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

13. NORTH AMERICAN FROZEN SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

14. EUROPEAN FROZEN SNACKS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN FROZEN SNACKS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

16. EUROPEAN FROZEN SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC FROZEN SNACKS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC FROZEN SNACKS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC FROZEN SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

20. REST OF THE WORLD FROZEN SNACKS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

21. REST OF THE WORLD FROZEN SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL FROZEN SNACKS MARKET SHARE BY PRODUCT, 2019 VS 2026 (%)

2. GLOBAL FROZEN SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

3. GLOBAL FROZEN SNACKS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US FROZEN SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA FROZEN SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK FROZEN SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE FROZEN SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY FROZEN SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY FROZEN SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN FROZEN SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE FROZEN SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA FROZEN SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA FROZEN SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN FROZEN SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC FROZEN SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD FROZEN SNACKS MARKET SIZE, 2019-2026 ($ MILLION)